- Cricklewood Manor

Waterkloof \ Enjoy discounted rates when you book a 2 night weekend stay. Centrally located in the ... - Birdsong Guest House

Centurion \ Book a stay of 2 nights or longer and enjoy a 20% discount on standard rates. Birdsong Guest ... - More \ Johannesburg Specials

Johannesburg International Motor Show

Johannesburg International Motor Show

When? Starts 14 October (TBC) Photo & Film Expo

Photo & Film Expo

When? Starts 19 November (TBC)- More \ Johannesburg Events

Bush Walk in Plumari Game Reserve

Bush Walk in Plumari Game Reserve

Price Range (pp)?

Price on request Groenkloof 4x4 Trail

Groenkloof 4x4 Trail

Price Range (pp)?

Price on request- More \ Johannesburg Things To Do

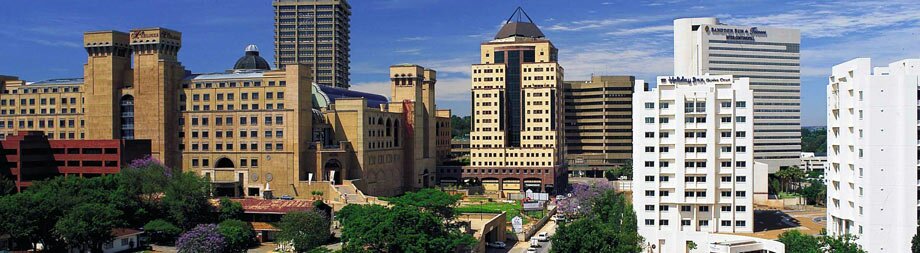

Johannesburg-Venues.co.za offers you a fine selection of properties in Johannesburg, from 5 star luxury hotels and lodges to smaller, less expensive boutique hotels to suit the more budget conscious traveller. All hotels represented on this site are registered and accredited accommodation providers.

Travel Insurance Credit Union Discount: Financial Membership Savings

When you’re planning your next getaway, don’t overlook the value your credit union membership can add to your trip. You could qualify for exclusive travel insurance discounts, helping you save money while protecting yourself against the unexpected. Plus, you’ll gain access to specialized coverage and extra financial perks designed for members. Wondering how these benefits can stack up for your next journey or what steps you’ll need to take to unlock these savings?

Understanding Credit Union Membership Advantages

Joining a credit union can offer significant financial benefits, particularly for individuals seeking to minimize expenses while traveling. Members gain access to certain exclusive discounts on insurance products, including travel insurance through established partners such as TruStage.

In addition to these discounts, credit union membership presents various options for managing finances, including Savings and Checking accounts, as well as Loan products tailored for both personal and business purposes.

Members can efficiently oversee their accounts through mobile banking services, locate branches in areas such as Houston, and utilize payment options including a debit or credit card. Furthermore, credit unions typically provide access to mortgage services, home equity loans, and direct deposit capabilities.

Additional resources may include financial calculators, guidance on privacy policies, and customer support options, such as live chat or contact services, to assist members with account management and inquiries.

This comprehensive suite of services can help members plan their finances more effectively and make informed decisions regarding their savings and investments.

Exclusive Insurance Discounts Through TruStage

TruStage offers a range of insurance discounts specifically designed for credit union members, which are not accessible to the general public. These discounts cover various types of insurance, including auto, home, renters, health, and life insurance, and are made available through your Union membership.

To utilize these benefits, members can pay using their account, card, or direct deposit. This initiative is positioned as a value-added service available at credit union locations across Houston.

Members are encouraged to explore the main site for additional resources, including financial calculators and specific insurance offerings. Should you require assistance, options to chat or contact customer support are provided.

It is worth noting that these reduced rates can contribute positively to overall savings while also aligning with privacy policy compliance. The offerings are designed to enhance financial well-being for members by providing access to favorable insurance rates.

How Travel Insurance Discounts Benefit Members

Travel often involves unforeseen circumstances, which is where travel insurance plays a crucial role. Members of Houston Federal Credit Union can take advantage of exclusive discounts on travel insurance through TruStage. This benefit translates into lower insurance premiums, which can contribute positively to your overall financial health as a member of the credit union.

These discounts are applicable regardless of the financial product utilized—whether you are utilizing a Visa Card, a checking or business account, or managing a mortgage or loan. This flexibility allows members to benefit from reduced insurance costs while engaging with a range of financial services.

The savings obtained from these discounts can be strategically reallocated, either to enhance your travel experiences or to bolster your personal financial resources. Furthermore, accessing these benefits is streamlined through mobile banking, available at any Houston Federal Credit Union location.

For further inquiries or assistance regarding travel insurance discounts, members are encouraged to reach out through the available communication channels.

Additional Savings and Perks for Travelers

Houston Federal Credit Union offers members a range of practical savings and benefits tailored for travelers. Membership facilitates access to valuable insurance discounts and various travel-related perks.

Through the Credit Union Travel Club, members may benefit from reduced rates on hotels, resorts, and vacation packages, potentially saving up to 70% on these expenses.

Additionally, the credit union provides members with various discounts applicable to both personal and business needs.

Members also have the convenience of direct deposit options and mobile banking services at Houston locations, ensuring easy account management.

Payment transactions can be efficiently conducted using the Visa Card offered by the credit union, which also provides access to resources for mortgages and equity.

Should members encounter issues, such as lost cards or forgotten passwords, multiple support options are available, including search functionalities, chat support, and direct contact methods.

This range of services underscores the financial advantages and convenience provided to members of the Houston Federal Credit Union.

Eligibility and Steps to Access Insurance Savings

To access insurance savings at Houston Federal Credit Union, it is essential to first establish membership, which necessitates a minimum deposit into a share savings account.

Following the setup of your account, you can log in through mobile banking or online by utilizing a Visa or Credit Card for either direct deposit or payment functions.

Once logged in, you should navigate to the main Resources section for Insurance. Here, you will be able to select the relevant discount and follow the streamlined application process. The credit union offers various types of coverage, including Personal, Business, Mortgage, and Equity insurance, facilitating an accessible experience for members seeking savings in these areas.

For additional support during the process, you can utilize the "Contact Us" or "Chat With Us" functions, or visit one of the physical locations in Houston.

This structured approach aims to simplify the process of obtaining insurance savings for credit union members.

Enhancing Financial Wellness with Member Tools

Utilizing the member tools offered by Houston Federal Credit Union can facilitate a more organized approach to travel insurance and enhance overall financial wellness. Members have access to various resources including Financial Calculators, mobile banking applications, and online account management systems. These tools enable individuals to monitor their Savings, Checking, and Loan balances effectively across main credit union locations.

Additionally, direct deposit services aid in the management of personal finances, ensuring timely access to funds. Members may also benefit from exclusive insurance discounts, available through their union membership, which can contribute to potential cost savings on various insurance products.

The credit union provides comprehensive resources pertaining to Club memberships, Lost Card assistance, Mortgage Equity options, and Visa payment solutions, which can enhance the member experience.

Interested individuals can initiate the membership process by clicking “Become a Member,” exploring available insurance offers, or reaching out via the “Contact Us” feature. For further assistance, users can also access options for password recovery or engage in a chat for immediate support.

This structured approach to financial wellness can lead to informed decision-making and improved financial outcomes for members.

Community Partnerships and Expanded Travel Savings

Houston Federal Credit Union offers its members exclusive travel insurance discounts and savings through established community partnerships. Membership grants access to various insurance options via the Credit Union Travel Club, potentially resulting in reduced costs on vacation packages and coverage.

Members can benefit from various account types, including Checking, Business, and Personal accounts, which are designed to enhance financial benefits at Houston locations. Payment flexibility is available through the use of a card or direct deposit, allowing members to leverage club resources efficiently.

For further information, members can utilize multiple channels, including searching online, clicking the appropriate links, or engaging in a chat with customer service representatives.

Additionally, account support is accessible via mobile banking or through the site's map feature. For detailed inquiries, members are encouraged to contact the credit union directly.

Copyright © Rights Reserved.

Staying Informed About Member Benefits and Offers

Maximizing the benefits of your credit union membership requires staying current on available offers and resources. Regularly monitoring your credit union accounts is a practical approach to keep track of any updates or changes.

Utilizing mobile banking can enhance accessibility, enabling you to manage your finances more efficiently. Engaging with primary resources such as financial calculators can assist in making informed financial decisions.

It is advisable to explore special offers available within your account settings, as these may provide opportunities for savings. Additionally, joining programs like the Travel Club or utilizing your credit card for applicable discounts can further enhance your membership value.

Maintaining communication with your credit union is important. You can find support through various channels, including visiting local branches or using contact options such as phone or chat services.

If you encounter issues with account access, it is recommended to reset your password as soon as possible to ensure continued access to your accounts.

For comprehensive navigation of the services available, regularly reviewing the site map, privacy policy, and other related documents can offer crucial insights into your rights and the terms of your membership.

Conclusion

Choosing travel insurance through your credit union can offer real savings and peace of mind. By taking advantage of member discounts and personalized support, you’re better equipped to protect both your finances and your travel plans. Remember to review policy details closely and reach out for guidance if needed. These benefits aren’t just about cost—they’re about smarter, safer journeys. Stay informed and proactive, and you’ll make the most of your financial membership on every adventure.